32.24 Stock Market Masterclass

Introduction

- The course is divided into three buckets:

- Macroeconomics

- Distinguishing between good and bad businesses

- Identifying overvalued and undervalued stocks

- The course is designed in a storytelling format

- Watch the video in a sequential manner

- Complete Homework and lectures.

- Look out for emails specific to the current stock market dynamics.

- 30% of learning will come from the course, and the rest from engagement with the community, homework, etc.

Section - 1 Chapter-1 Macroeconomics

Macroeconomics and Stock Market

- Credit flow

- Asset Inflation

- Asset classes like Gold, Bonds, real estate, Stocks, etc. get inflated when more money gets printed.

- Over the long term, the stock market always increases due to inflation and money printing, causing credit flow into it.

- On the other hand, if credit flow is withdrawn from the market, the stock market index price will decrease.

Quantitative Easing

- Quantitative Easing (Money Printing)

- In 2008 crash, the USA federal bank used it extensively to bailout the banks.

- There are two kinds of GDPs are there:

- Nominal: It has the concept of inflation added to it.

- Real

- A country's (GDP) growth is determined by:

- Population growth: Population increases cause more transactions among people. More money flows into the market, which causes an increase in the country's GDP.

- Productivity growth: When the labor force finds a new way of delivering more products with less effort, the GDP increases.

- Quantitative Easing or Velocity: if more money gets printed, more money will come into the market, which causes inflation and inflation causes an increase in GDP. There are two methods to it.

- Print money out of thin air

- Bond operations: takes kind of loan from future and distribute it in present.

- QE causes asset price inflation which causes credit flow into the stock market.

- However, QE causes inflation in the economy which may go out of hand. Moderate inflation is good for the economy and keeps people in their homes. High inflation causes people come to the streets.

Quantitative Tightening

- Quantitative Tightening means withdrawing money from the market.

- When interest rate increases people start borrowing less and saving more. This decreases flow of credit in the market.

- Central banks (like RBI) usually do this through the repo rate and liquidity ratio setting of banks (like SBI).

- QE and QT game is the key to stock market investing.

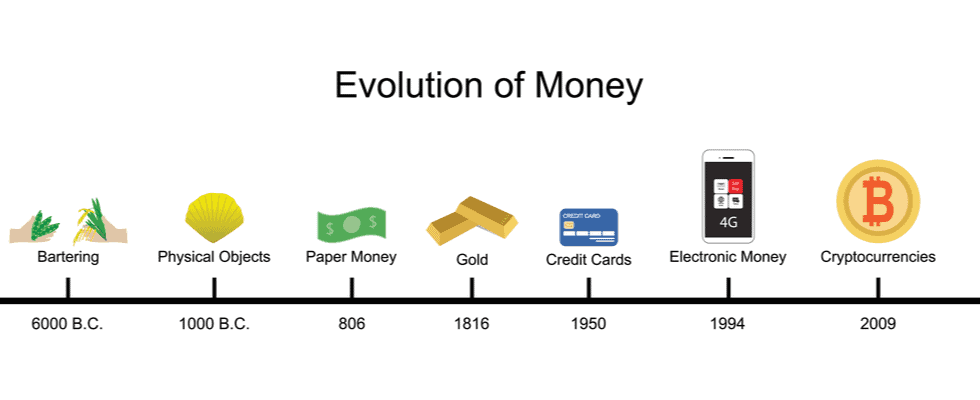

History of Money

- Gold is indestructible and it has limited supply.

- Buy real things for a doomsday scenario. Which will happen as Govt. will f*ck up in our lifetime or on next generations.

- Buy in 35.11 Gold not in SGB. Buy REs not REITs.

- In short do not trust the Govt.. You are responsible for your future in India Govt. will never back unless you are a friend of Govt. (big corporates you know).

How QE impacts us

- The USD is not coming down in next 10-20 years for sure or it may not come down in our lifetime as it strngthen itself more even with loads of money printing during CoVID-19.

- Why does the Govt want the stock market to grow up?

- GDP of a country is correlated with its stock market performance.

- If stock market goes down and down it will pull down the GDP of the country. Which in removes out other countries doing transaction with the country.

- FIIs (Foreign Institutional Investors)/DIIs (Domestic Institutional Investors) will not and can not let the stock market fall in a long term perspective. If there is no return in share market then people will stop investing and the DIIs AUM (Asset Under Management) will go down which causes their profit % commission to goes down.

- The FIIs due to their large portfolio can not withdraw from a single stock at a single time due to some bulk deal regulations and scarcity of bulk buyers. It may cause a stock to be in oversold zone and they can not sell the stock at all due to lower circuit.

How money flows internationally

- Money flows from riskier economies to less riskier economies.

- Lagging and leading indicators

- Lagging indicator means the study of history

- Leading means the study of future and anticipating moves.

Section-1 Chapter-2 Stock market

Basics of Stock Market

- Players in the market:

- FIIs (Foreign Institutional Investors)

- DIIs (Domestic Institutional Investors)

- Investors

- Traders

- Retail investors can not time the markets. News -> Share price

- You can estimate the valuation of a stock. But, you can not compute the intrinsic value of a stock.

- Having a hypothesis is important.

- Retail investors loose money because they are unable to hold the stocks when it is falling. Why?

- Because they do not have a hypothesis at the time of buying the stock i.e. why am I buying the stock. Why the price is falling?

- Stock Market in India always makes a new high.

- Mutual funds and FIIs with large AUM get difficulties in jumping around between stocks as it is hard for them to BUY and SELL stocks in large amount within a short pan of time. However, on the other hand a retail investor like you can jump around stocks and beat the FIIs and DIIs.

- Check the large investors: thru this website

Investment System

- Types of investors:

- Growth Investor: Do not care about the price they just buy good stocks and keep holding until the fundamental changes like Saurabh Mukherjee.

- Value Investors: Buy low with some intrinsic value. It's dying slowly due to credit flow. Warren Buffet

- Deep Value Investor: Manish Obroi. Buy really cheap stocks and hold it.

- Vijay Kedia's investment style. Whether founder is ambitious and has hunger to grow more. He buys 10 stocks. 7 Goes to 0. Rest will be multi-baggers.

- Masayoshi Son's investment style. He watches into founder's eye and decides whether to invest or not.

- Always buy the companies where you can hold them in case they fall by 10-15%.

Do you want to be an investor or trader?

Define 3, 5 and 10 year portfolio size via https://groww.in/calculators/sip-calculator

How much loss can you see on your portfolio? -10%. -20%, -30%, -40%?

Put a tag. For example I am a high risk, high reward investor looking for a return of > 20% per annum.

Key Points

- Macro investing is a great option.

- There is information asymmetry in the stock market.

- Macro investing bridges the gap.

- Figure out your investment style. It gets evolved with time. However, do not switch frequently when the share price decreases.

- Simplify the investment style. Make it narrative/your theory basis. Do not give it up until fundamental principle changes.

- Do not time the market. However, when the opportunity is in front of your eyes, do not hesitate. Buy the dips.

- Stock market is designed to go up.

- If for a good business or NIFTY50 a all time high was reached, it will be reached there again and it will be achieve a new high for 100%.

Portfolio Building

- Markets are managed by the Govt. It is not a free market.

- Nikkei does not go up due to their Govt.

- M1 Money Supply: Liquid money that flows through the economy.

- Media is controlled by companies and big operators. Do not watch news.

- Simplest way to beat inflation: Index Investing

- 1 crore portfolio

- 30% into Real Wealth (Real Estate, Gold)

- 20% into Cash flow generating assets

- Rest

- Index Fund -> If you do not have time to monitor market (passive investing)

- When the market gives clear signals whether it is bull or bear run then it makes sense to do individual share investing not index investing.

- Profit booking in index funds is a bit challenging.

- Do Channel Trading in a sideways market.

- Equity

- Index Fund -> If you do not have time to monitor market (passive investing)

- Do not invest more than 5-10% of your portfolio in any stock.

- Type of Portfolio

- Core (Buy and Forget)

- They do not have competitors or Oligopoly market.

- HDFC is an exception.

- Opportunistic (If opportunity arises then sell.)

- Core (Buy and Forget)

- Processed things give better RoI than raw things. like Oil, Commodities.

- 100 - Age rule

- Suppose my age is 30 then 70% of my portfolio should beat inflation.

Core Portfolio

Checklist used by Akshat Shrivastava to select a stock for his core portfolio:

- Zero debt

- Excellent Brand value

- Monopoly

- Chances of survival > 90%

- Growth

- Is it company can be replaced? MOAT?

Easiest strategy to get money in stock market as a beginner.

- Invest in NIFTY50

- Sell Nifty50 when it is overvalued and invest in HDFC Bank/HUL/TCS/Nestle

- Sell HDFC Bank when it is overvalued and invest in Nifty50

- When any of the above two are undervalued, close your eyes and buy heavily.

People in India and other developing countries are moving away from generic massy brands to premium brands for themselves, their parents and their children. Everyone wants to increase their lifestyle. The price and profit is at the premium segment of the market not at cheap value products.

Products/Commodities where branding does not matter, does not matter.

Stock Analysis

Good vs Bad Business

- TAM: Total Addressable Market

- How many perspective customers are there and how much can they pay?

- B2B: Less transactions but high product value

- B2C: More transactions but lesser product value

- Premium B2C: Less Transactions but high product value

- Value Capture

- Do not buy commodities companies, buy a product who adds value to the commodity and selling to clients.

- Do not invest in companies which do not have pricing power. Except: Finance Stocks

- Types of products:

- Inaelastic Product: Medicine, Alcohol, Cigarrettes, Instagram. <- Invest here

- Elastic Product: Pizza, Amrutanjan Balm, Steel

Your goal is to always get the best possible return on the money you have right now.

-

For example, suppose you are in a 20% loss of a stock and you are thinking whether to sell or hold it. Then think the above statement and decide what is the best productive way for you rmoney right now. Though you are in 20% loss now and you are sure you will cover your losses if you stay put for another six months, but you have an opportunity stock which can give you 50% return. Book the losses and rotate your money.

-

Three aspects and only three aspects are needed to make money:

- What to buy

- When to buy and

- When to sell

What to buy

- We need good assets to buy. To find good assets we have to eliminate bad assets first.

- A simple formula to elimintae bad stocks on screener:

Debt to equity < 10 AND

Market Capitalization > 1000 AND

Return on capital employed > 15

On 20% efforts you can get 80% result.

If you go deep and spend more time on the concepts answering 5-whys principle, the efforts will be 80% but returns will be 20%.

You have other things to do in life, so no need to go deep. Focus on what is relevant and keep moving.

RoCE

- RoCE (Return on Capital Employed) suggests on 100 rupees invested in the company how much is the company providing the return. The higher the better.

- It is always of previous year.

- Two different industries RoCE can not be compared.

CoC

- CoC (Cost of Capital) is the cost of the capital of the company.

- In India the CoC is roughly 8%.

- Suppose a company got 100 cr capital in loan at 10% interest rate then their CoC is 10%.

- If we add inflation as 7% then the RoCE should be more than 17% to make the company a good asset.

A checklist to identify good assets

- TAM 🔼

- Industry Growth 🔼

- Debt 🔽

- Capital Intensive Buisnesses ❌

- Brand Power 🔼

- Nature of Product

- Blue Ocean (Relatively new industry with limited competition for the time being like Zerodha initially)

- Ability to survive Red ocean

- Value chain analysis

Business Analysis

- Porter's framework

- CCCP framework

- Company: Strength and Weakness

- Competitor

- Customer: TAM

- Product: What are the products?

- The only way to identify a multi-bagger is not technical analysis, not fundamental analysis, but business analysis.

Research On Coinbase:

- How does it make money?

- Is it profitable?

- Is it 0-1 or 1-N type company?

Tools:

- Tickertape

- Tijorifinance

- Screener

- Yahoo Finance or YCharts

Tech Stocks

- No asset is evil or sacrosanct

- Money is made by all the assets even with high debt companies

- You will make money where you understand

- Basic -> Balance Sheet

- Industry Trends

- Nature of the asset

- When asset starts acting check all the above three points

The business model of the large tech companies is to find the next best tech and leverage it to get money.

- Tech companies are not sticky business like FMCG products. If people get a better product no matter how relevant and easy google search is they will move to ChatGPT.

- Tech companies are in attention grabbing business.

- Criterias to check on the tech stocks

- Where is their roadmap three years from now -> Obviously not as they are doing now

- Do they have capacity to survive -> Massive cash balance

- Can they latch on to the next big thing on tech? -> Big companies will make R&D else will acquire

Portfolio Building Strategies

1. Simplest investment strategy

- Buy good assets

- Index funds

- Bulk buy on every dip

- Do not do SIPs

- Have an exit strategy like once I make 30% unrealized gain I will sell.

- Only buy at the consolidation phase or on dip.

- When you get the chance book 10-20% profit booking, called as partial profit booking. This will give you additional cushion to stay put. On these profit money you can do fixed deposit and wait for the next dip.

- Mutual funds

- Bluechip stocks

- Index funds

- Hold them through thick and thin

- Understand why the asset got up or down

- Do not give a f*ck if others are buying BTC and making money. Stick to your strategy.

2. Moderate Investment strategy

- First you need to create a balanced portfolio. If you can not make one, learn this first and do not enter without making a balanced portfolio.

- Start slow and aggregate individual assets when you fully understand the nature of the asset.

- Fix your risk and reward equation

- Avoid higher beta cyclical/volatile stocks like L&T

- Sharpe Ratio

- Capital Rotation

- Hedging

- Keeping Track of Macros

Key Points

- Macro analysis and advantages of macro investing

- You must know fundamental and business analysis

- Funda: Analyzing Industry to find its growth potential

- Biz: Looking internally in a company to see its potential

- Revenue source

- Expansion opportunities

- Competitive advantages

- Avoid red flags like highly debt companies with no intention to reduce the borrowings

- Risk and Reward ratio you can find by this.

- Learn Technical Analysis

- Overvalued/Undervalued assets

- Convert a large part of your portfolio into Core portfolio

Always use combination of Macro + Biz + Funda + Tech analysis before buying or selling a stock.

Macro is the most powerful out of these all investing analysis.

- Follow the black box theory

- No matter how hard you try you will always have incomplete information for a stock. Even in the company you are working for.

- You have to take a calculated risk.

Commodity Stocks

- The demand for commodities will always go in a linear way.

- Commodity shares will have cycles in their price.

- Commodity companies make profit on pricing game.

- It's good for swing trading.

PSU Stocks

- A large population of India believes in PSU banks more than private banks.

- PSU banks lose money by giving out bad loans.

- Do not invest in these stocks. If you are investing, do not invest in a high zone.

- Govt. will siphon out profit from PSUs if they make a profit. That's why they are cyclical.

Small and mid cap investing strategy

- screener formula

Market Capitalization < 5000 AND

Debt to equity < 15 AND

Return on capital employed > 15 AND

Sales growth 3Years > 15

- Detect good vs bad small caps

- Engineering Brand problems -> The company's product should have demand and it should be able to survive the next few years.

- Cash flows

- Cash from Operating Activity + Cash from Investing Activity should be positive.

- Industry growth of core products

- Check the company is generating revenue from its core products not from some other one time activities.

- RoCE should be high

- Price volatility will be high

- No red flags on promoter holding

- SEBI has rule that promoters can not keep more than 75% share of a company with them.

- Also promoters dilute equity to bring capable management onboard.

- A few companies can be completely managed by professional and there may be no face of the company like ITC.

- If promoters + FIIs + DIIs + HNIs (inside Public section) are getting down consistently then stay away from this.

- In that also check which FII and DIIs are buying. An FII/DII with less number of investments under them is not a good one and not dependable. Shell companies can also be shown as FII.

- In IRCTC, public shareholders are increasing, which is not good sign.

- Understand the story behind the numbers

How to pick stocks for your portfolio?

- A portfolio will go through a journey.

- Very small inception portfolio

- Do not get into churning strategy like let's buy today a stock, tomorrow I will sell it and optimize my portfolio.

- Your primary goal is to build a decent size portfolio. Build a core portfolio.

- Do not focus on selling.

- Mid size portfolio

- Start building a good core portfolio

- If a stock fail by 20% in a day and you did not panicked and sold, then that is a core portfolio stock for you.

- Large size

- Create an investment system

- For e.g. invest 50% of earning irrespective of whatever happens.

- Create an investment system

- Very small inception portfolio

- Are you should not buy a stock never ever?

- This stock should be part of your investment thesis.

- Best to stick to the system that has worked for you.

Akshat's startegies

- There are hedging in every type of stock i.e. there are 35 types of stock categories, but in total 70+ stocks.

- HDFC + ICICI = 1 share category

- HUL + Nestel = Another category

- 99% of his income he saves due to excess income and less spending.

- Play margin of safety. Do not BUY in bulk at a time.

- For volatile stocks increase the number of times when you buy the stock.

- Never buy a stock when it is in the increasing momentum or at the top. Buy when it is either consolidating or decreasing.

- We are retail investors and we do not have complete information. Therefore, never ever invest more than 5% of your portfolio in a single stock.

- If your 5% is reached and still a stock is decreasing then do not buy anymore.

Real Estate

- To buy a land of 1 crore, you will pay 20 lakhs down payment + 80 lakhs loan

- Suppose interest rate is 8%.

- To buy 5 such more properties you need to pay 5.6 lakhs EMI.

- Do not have your EMI go excess than 30% of your income.

Building Investing Narrative

-

5% max position in any stock.

-

I will invest in an installment manner and not bulk buy.

-

I do not need to make profit from one stock only.

-

My overall portfolio should be positive.

-

PE should not be taken as absolute terms with the time of the same stock.

-

But it should be a relative comparison between stocks in the same industry.

International Investing

- You can never compute the intrinsic value of a company.

- Tech stocks are not in India but in the USA.

- Google, Apple and Meta with billions of free cash flow will never go out of the market in a near term. They will buy the next big thing with this cash to stay relevant.

Private Equity

- Large companies buy the farms in discount as they were highly leveraged like ByJu's.

Investment Thesis

- Pick the segment winner's theory

- Pick cash cows when they are at discount like Walmart and McD

- Pick winners that have a defendable MOAT like Amazon.

- Do not buy the stocks which you do not understand and go the ETF way -> USA Healthcare ETF

- Bet on emerging techs

- Hedge against your india portfolio.

Taxation in the USA Market Investing

| Types of Tax | Term | Indexation Benefit | Tax on Gain |

|---|---|---|---|

| Long Term Capital Gains Tax | More than two years | Yes ✅ | 20% |

| Short Term Capital Gains Tax | Less than two years | No ❌ | As per Indian Income Tax Slab |

| Dividens Tax | Not Applicable | Not Applicable | 25% broker cuts it |

There are two types of taxes:

- Capital Gain Taxes

- LTCG > 2yrs -> 20% on profit with indexation benefit regards to Indian inflation

- STCG < 2yrs -> As per Income Tax Slab with no Indexation benefit

- Dividend Taxes

- 25% of dividends will be withheld to the broker.

- If you are not getting large amont (how much?) of dividends then you can ignore this

For more on Taxation see: Tax Planning For Salaried Employees in India

In short, how to pick stocks

After all the lessons so far, to cut the long story short, here we will squeeze down all the concepts into a few fundamental systematic way of picking stocks:

- Do a fundamental and business analysis of the individual stock and the industry.

- Do a technical analysis and determine the right time to buy the above stock.

Step-by-step process on how to research from scratch

- Use a screener to narrow down the scope of companies.

- How does the company make money?

- Is it an aggressive or defensive industry?

- Anything higher than inflation is a reasonable industry growth rate.

- You do not need to do a Ph.D. in the company. Check if you can understand 80% of the industry.

- Use Frameworks:

- CCCP and

- Porter 5 framework

- How the farm is going to grow? Is it going to grow?

- Is there any red flags? -> What is the number one concern for this industry?

- The $1 rule of Warren Buffet should be working out on the stock, i.e., profit should come back to investors either via dividends or stock price appreciation.

- This rule is only for small and mid-size companies.

A small company can grow in two ways:

- To use its own money

- To procure debt to grow

Timing the market

- 200 DMA to check overvalued or undervalued stocks

- Use Market Mood Indicator

Resistance and Support

- The probability of the Resistance trend line getting broken is higher than the support line getting broken.

- A good asset price always grows due to more demand and less supply, like the iPhone, BTC, and Nifty50.

- Channel investing to buy on support and sell on resistance.

Interest Rate Theory

Impact on the Stock Market

- Check the USA interest rate from this site.

- Think about what will happen in the long term after six months.

- If you foresee interest rates dropping, more money will come to the share market, especially the growth stocks.

Impact on Real Estate Market

- The FIIs will invest more in emerging economies like India.

- When the interest rate goes up, there will be fewer RE buyers as the loan rate will increase. At that time, properties will be cheaper if a cash deal is made.

Think about making 10cr in 3 years, than 1cr every year.

Sudden Gain Rule

- When there is a sudden growth in a particular large-cap stock, you should not buy it in that zone. Please wait for it to come down.

How to sell stocks

ak********[email protected] -> Portfolio review

Over/Undervalue assets

- Do not buy hyper overvalued stocks.

- Always invest in an IPO stock after its price discovery.

- If stock gives a run up and you are holding then book 20% profit.

- For fresh positions, wait for the stock to consolidate.

QnA

- Dubai's AED is linked with USD. that's why if you earn in AED you will gain 5% per annum as per INR. As INR depreciates 5% compared to USD.

Microcaps

- These are companies with market cap of < 1000 crores approximately.

- First earn enough money to stabilize yourself with RE, 10cr, Emergency Fund, etc. then if you have additional cash flows coming in, invest in the micro caps.

- Micro caps is a rich people's game. Micro cap makes the difference between rich and super rich.

- A stock price increses due to three reasons:

- P/E expansion

- Fundamental improvement like profit increases

- Sentimental value increase (recently happened for NVIDIA)

- Invest in decades term.

- Steps to make money

- You do direct equity investing

- You invest big

- You time the market

- You are ok to see -30% loss in your portfolio.

- Small and Midcap investment

- Microcap investing <- Before reaching here, you should complete the above five steps first.

- If macro economy is bad, if the stock make good also it will not perform.

- Pointers to analyze the economy:

- GDP growth

- Inflation: Inflation high -> Interest rate cut -> Share market down

- Interest Rate

- Unemployment situation

- World Trade flow

- Debt: Excess debt -> Govt may try to reduce debt by decreasing IR